In the run-up to the Christmas holidays, UK consumers have been attracted to a tempting offer from Moneyful Ltd. It promises “easy money” in exchange for providing personal data such as copies of documents and banking information. However, experts warn that behind these tempting offers lie significant risks.

What is Moneyful Offering?

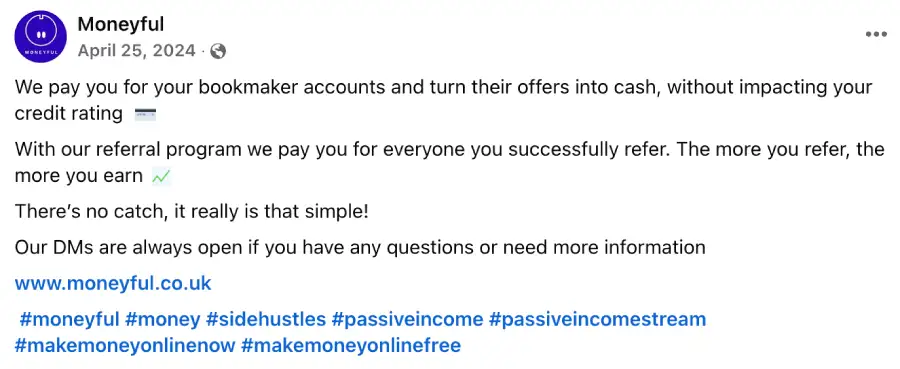

The company claims that customers can earn up to £150 by sharing their personal details and receive additional bonuses for referring others. The process is straightforward: users upload copies of their identification and proof of address, which Moneyful uses to create betting accounts. With these details, the company manages the accounts, employing techniques such as matched betting – a legal but controversial way to profit from bookmaker bonuses and promotions.

While matched betting is not illegal, bookmakers actively shut down accounts when they detect such practices. If caught, users risk account closures, personal data misuse, and potential legal complications.

Privacy Concerns and Ethical Questions

Experts in financial security from Cifas and Which? Money emphasize that sharing personal information with third parties is not only risky but can also be dangerous. By handing over sensitive data, consumers expose themselves to potential fraud and misuse.

Advisors strongly urge caution: “Any offer to earn money that seems too good to be true, probably is” says Simon Miller, Director of Communications at Cifas.

Manipulation Through Social Media

Moneyful aggressively promotes its services on Facebook and other social platforms, using enticing slogans like “Have a Financially Merry Christmas” and “Earn Extra Cash for the Festive Season”. The psychological appeal is clear: during the holidays, when expenses are higher, people are more vulnerable to such manipulative messaging.

Additionally, platforms like Telegram and Reddit are rife with anonymous accounts offering to buy or sell “clean” betting accounts. Professional gamblers use this method to bypass restrictions imposed by bookmakers, further muddying the waters.

Moneyful’s Response and Legal Perspective

In response to criticism, Moneyful asserts that it operates legally and transparently. The company highlights that it pays taxes, is VAT-registered, and even boasts a Trustpilot rating of 4.3. Representatives frame their business as a “passive income” model, likening it to investing in stocks and shares.

However, experts argue that such justifications fall short. Entrusting personal data for participation in gambling schemes remains highly questionable from both a security and ethical standpoint.

Why This Matters

The Moneyful scandal highlights a broader issue – the growing number of companies exploiting people’s financial vulnerabilities. Amid economic challenges and holiday expenses, consumers are becoming easy prey for such schemes.

The main takeaway from this story is the importance of vigilance. Never share personal data with unfamiliar organizations, no matter how attractive their promises may seem.